January 05, 2024

In September 2023 the Chicago City Council approved placing a referendum on the March 2024 primary municipal election ballot asking voters to approve a change in the structure of the City’s real estate transfer tax (RETT) from the current flat rate to a graduated rate. The tax would be imposed on buyers of properties. The tax proposal has been described as a “mansion” tax, but it would apply to commercial and industrial as well as high value residential properties.

Revenues from the graduated RETT increase would be earmarked for programs combatting homelessness. This would include providing homeless populations with permanent affordable housing and related support services such as mental healthcare, substance abuse counseling and connections to other social services. Programs related to housing would be administered by the Chicago Department of Housing while support service funding and programming would be managed by the Department of Family and Support Services.

The City of Chicago reported that 6,139 people experienced homelessness based on a point-in-time count conducted on January 26, 2023, a 58% increase from the prior year. However, the Chicago Coalition for the Homeless estimated that there were 68,440 people experiencing homelessness in 2021. The larger number in the Chicago Coalition’s report is because they include people temporarily staying with others in the count to reflect all forms of homelessness, while the City’s estimate only includes the number of people living in shelters or unsheltered areas not meant for habitation. The City’s 2023 report included 2,196 asylum seekers but does not reflect the thousands of additional migrants who have arrived in Chicago since then.

Supporters of a “mansion” tax targeting funding for homeless programs argue that the City’s efforts to combat homelessness have been inadequate. Even though they use different methodologies to count the number of people experiencing homelessness, both the City and the Chicago Coalition for the Homeless concur there have been significant increases in the number of unhoused individuals recently. Supporters also argue that the proposed RETT increase would affect only about 4.2% of all real estate transactions in Chicago, targeting only the most highly valued properties. Approximately 94% of properties would see a decrease in the applicable tax rate.

Opponents of the transfer tax increase note that the impact of a transfer tax increase would be borne primarily by commercial properties. Downtown office occupancy rates have not rebounded to pre-COVID 19 levels, resulting in sharp decreases in property valuations of as much as 40% to 80%. Commercial property taxes are among the highest in the nation. Finally, regular fluctuations in real estate tax revenues over time due to market shifts may make the transfer tax an unreliable source of revenue for homeless programs over time.

In addition, the Illinois Answers Project of the Better Government Association found that the City has been slow to spend funds it currently has budgeted for homelessness relief. For example, as of August 2023 Chicago had only spent 15% of $52 million in federal American Rescue Plan funds allocated through the Chicago Recovery Plan for homelessness support services.

In a lawsuit filed in Cook County Circuit Court on Jan. 5, 2024, a group of real estate organizations challenged the legality of the wording of the RETT referendum. They argue that the Illinois Constitution only allows a single question in a ballot issue. But the RETT referendum asks voters to approve three separate marginal rates, thus unconstitutionally posing three separate questions. Also, they argue that Illinois law only allows referendums to raise existing or impose new taxes but that the referendum violates this principle as it decreases the RETT on properties valued below $1 million.

Real estate transfer taxes in the U.S.

A real estate transfer tax (RETT) is imposed upon the privilege of transferring title to, or beneficial interest in, real property. State and local governments in 34 states impose this tax, including Illinois. Rates range from 1 cent per $100 of property value in Colorado (0.01%) to 4% of property value in Delaware and Pennsylvania (including both state and local tax rates). The State of Illinois imposes a flat tax of 50 cents per $500 in property value. Some of the transfer tax rates are calculated on a marginal basis and others are based on a flat rate.

Seven states impose a “mansion” tax, that is, a graduated real estate transfer tax on expensive properties valued above a threshold amount. They include:

- Connecticut: A 2.25% tax on properties exceeding $2.5 million;

- District of Columbia: A 1.1% tax on the sales of properties valued at less than $400,000 and a 1.45% rate on sales above $400,000.

- Hawaii: Marginal rates range from a 0.15% RETT on sales below $600,000 up to a 1.25% tax on sales of $10 million or more.

- New Jersey: The RETT is a sliding scale that ranges from a 0.4% tax on sales below $150,000 to a 1.2% tax on property sales of more than $1 million.

- New York: Sellers pay a 0.65% RETT on commercial property sales valued at more than $2 million and residential sales above $3 million, while sellers of all other properties pay a 0.4% tax. Buyers are charged an additional 1% to 3.9% tax on residential purchases of $1 million or more. There are eight tax brackets based on various sales prices.

- Washington: The graduated rates range from 1.1% for property sales below $525,000 to 3% rate for properties above $3,025,000.

- Vermont charges a RETT of 0.5% on principal residences with a value less than $100,000 and 1.45% surcharge on all non-principal residence as well as principal residence with values over $100,000.

Several local governments also levy real estate transfer taxes in addition to the state RETT. For example, Philadelphia’s rate is 3.278% and San Francisco’s top rate is 6.0%

Recent Local “Mansion” Tax Efforts

Voters in the City of Evanston, Illinois approved a ballot measure to impose a flat rate graduated real estate transfer tax in November 2018 by a 53% to 47% margin. Properties selling for up to $1.5 million continue to be taxed at a 0.5% rate, but sales valued between $1.5 million and $5 million are now taxed at 0.7%, while sales worth over $5 million are taxed at 0.9%. Initially the tax was not earmarked for specific purposes, but in 2022 the City moved to use the RETT funds for its reparations initiative.

City of Los Angeles voters approved increasing real estate transfer taxes in Measure ULA in November 2022 by a margin of 58% to 42%. The measure increases transfer taxes from a flat rate of 0.45% for all properties to graduated marginal rates of 4.45% for high value properties costing between $5 million and $10 million, and to 5.95% for properties worth more than $10 million. In August 2023 the Los Angeles City Council approved a $150 million plan to spend funds raised through Measure ULA for six programs: short-term emergency rental assistance, eviction defense, tenant outreach and education, direct cash assistance for low-income seniors and people with disabilities, tenant protections, and affordable housing production.

Original estimates were that $900 million per year would be raised with the RETT increases. However, the estimates have been revised downward to $672 million. The lower figure has been attributed to a sharp decrease in high value property sales, high mortgage interest rates, a real estate market that has not yet recovered from the effects of the COVID 19 pandemic and the use of tax and accounting loopholes by wealthy property owners.

Measure ULA has faced two challenges since it was approved: a court case challenging its constitutionality, which was dismissed in October 2023, and a statewide ballot initiative in 2024 requiring a two-thirds affirmative vote on any local tax increase proposals going back to January 2022. If passed, the initiative would repeal Measure ULA as it does not meet the two-thirds affirmative vote threshold.

In November 2023 voters in Santa Fe, New Mexico approved a “mansion” tax by a margin of 73% to 27%. The 3% tax will be imposed on residential properties valued at over $1 million. The tax only applies to the value of the property over $1 million; there is no tax on the first $1 million in value. The tax is projected to generate about $6 million per year and proceeds would be deposited in the City‘s affordable housing trust fund, which underwrites housing, provides assistance for low income homebuyers and provides rental assistance.

Current Chicago Real Estate Transfer Taxes

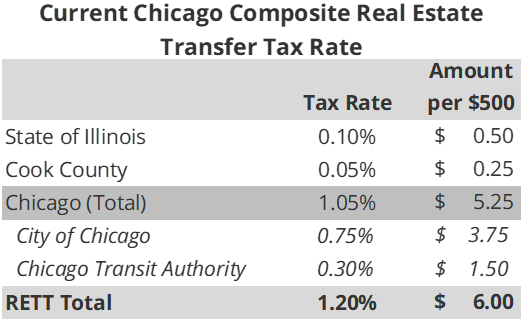

For properties sold in Chicago, the RETT is currently imposed at multiple levels of government by the State of Illinois, Cook County and the City of Chicago. The City imposes the tax as both a municipal and home rule real estate transfer tax. The composite rate of the RETT is $6.00 per $500 in property value transferred, or a rate of 1.2%.

The State of Illinois imposes a real estate transfer tax of $0.50 per $500 in value, or 0.10%. The County imposes a real estate transfer tax of $0.25 per $500 in value (0.05%). State and Cook County real estate transfer taxes are paid by the seller.

State transfer tax revenue is deposited into the Illinois Affordable Housing Trust Fund, the Open Space Lands Acquisition and Development Fund and the Natural Area Acquisition Fund. Cook County tax revenue is deposited into the County’s General Fund.

The City of Chicago currently imposes its own RETT at a rate of $3.75 per $500 in value (0.75%), plus a supplemental amount of $1.50 per $500 in value (0.3%) to fund public transit, for a total City rate of $5.25 per $500 in value, or 1.05%. The buyer is responsible for paying the $3.75 portion and the seller is responsible for paying the $1.50 portion of the City tax. The $3.75 per $500 in value portion of the tax is deposited in the City’s Corporate Fund. This portion of the City tax is projected to generate $142.2 million in revenue in FY2024. The $1.50 per $500 in value portion is transferred to the Chicago Transit Authority. This portion of the tax is projected to generate $56.9 million in FY2024. There are various exemptions to the real estate transfer tax. For example, the City of Chicago exempts sales under $500, bankruptcies and Enterprise Zone transfers from the tax.

Chicago real estate transfer tax trends

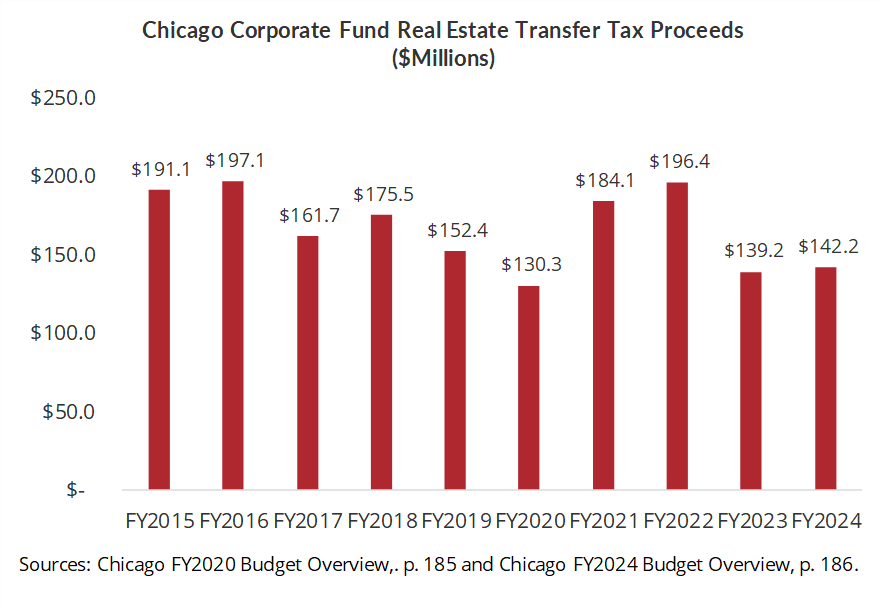

The real estate transfer tax is economically sensitive. Proceeds fluctuate depending on market conditions. When property sales are robust, revenues increase. The reverse is true when property sales and/or values decline due to negative economic conditions such as the COVID 19 pandemic, when commercial valuation fell and proceeds tumbled to $130.3 million.

The chart below shows the City of Chicago’s real estate transfer tax proceeds in the 10-year period between FY2015 through projected FY2024 amounts. These revenues include only the City portion deposited into the Corporate Fund, and excludes the portion directed to the Chicago Transit Authority. Proceeds have fluctuated in that period from highs of $197.1 in FY2016 and $196.4 million in FY2022 to a low of $130.3 in FY2020. In the entire 10-year period, tax proceeds are expected to fall from $191.1 million to $142.2 million, a $48.9 million or 25.6% decrease.

Proposed Change in Chicago Real Estate Transfer Tax

The proposed graduated RETT would decrease the tax rate owed on the portion of properties valued at less than $1 million and substantially increase marginal tax rates on the portion of high value residential and commercial properties worth over $1 million. Additional revenue over the amount generated by current RETT rates would be deposited into a fund earmarked for programs mitigating homelessness. The estimated extra revenue from the RETT change is $100 million.

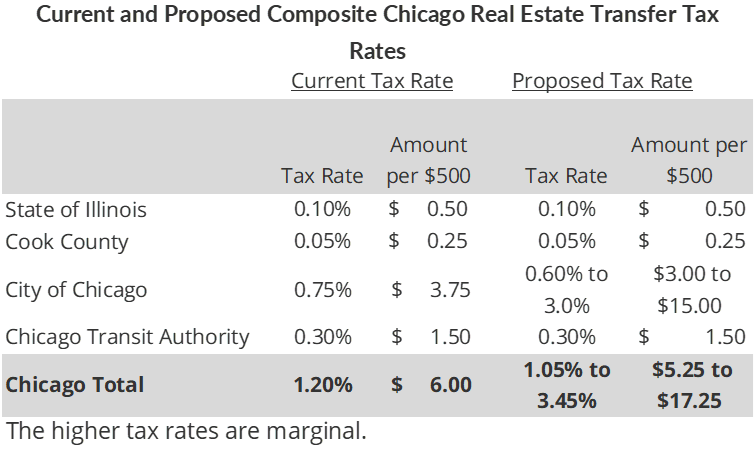

A property valued at less than $1 million would be taxed at a composite rate of 1.05% or $5.25 per $500 in value, a reduction from the current rate of 1.20% or $6.00 per $500 in value. The City of Chicago RETT would be reduced from 0.75% to 0.60%. These properties currently account for 94% of all sales.

The portion of properties valued over $1 million but between $1 million and $1.5 million would be taxed at a rate of 2% for the Chicago tax, plus the 0.6% rate for the portion below $1 million. The State, Cook County and transit transfer tax would still apply to the full price.

The portion of properties valued over $1.5 million would be taxed at a 3.00%, plus 2% of the value between $1,000,000 and $1,500,000, plus 0.6% of the value below $1 million. The State, Cook County and transit transfer tax would still apply to the full price.

The following chart compares the proposed composite rates to the current rates. To directly compare changes to the total rate, an effective rate for a property would need to be calculated for properties valued over $1 million. See the next section for such a comparison.

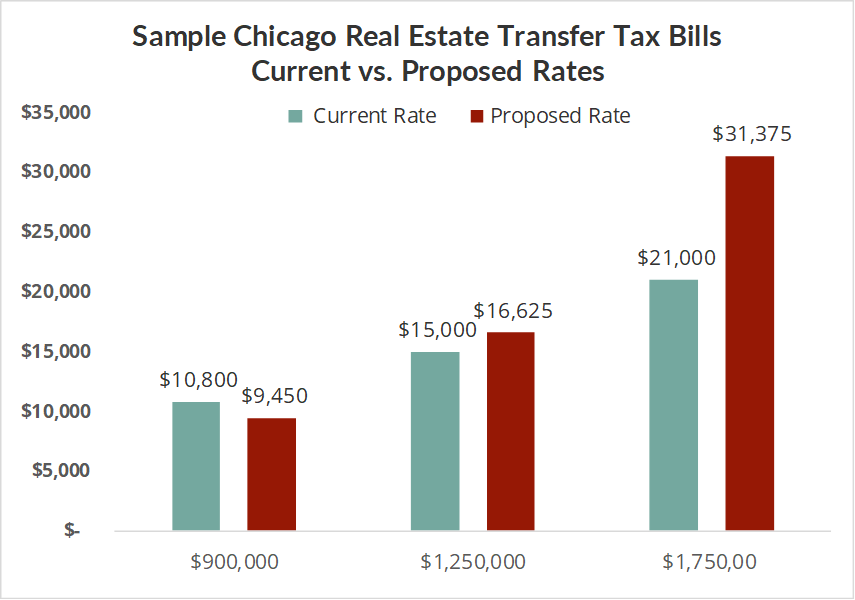

The following chart shows the impact of the proposed change in RETT taxation on sample properties, based on the composite rate for properties transferred in Chicago:

- Total billed transfer taxes on a property worth $900,000 would be cut from $10,800 to $9,450, a 12.5% reduction. The composite tax rate would fall from 1.2% to 1.05%

- A $1.25 million property would see its transfer tax burden rise from $15,000 to $16,625, or by 10.8%. The effective tax rate would increase from 1.2% to 1.33%

- A property worth $1.75 million would experience a 49.4% increase, rising from $21,000 to $31,375. The effective tax rate would increase from 1.2% to 1.79%.